Who can apply for Bank Rakyat Personal Financing-i Public?

Being a public servant has its own challenges; applying for a personal loan from a bank is one of them.

Bank Rakyat has the solution for you via its Personal Financing-i Public (Pembiayaan Peribadi-i Awam), specially tailored for those working in the public sector, selected GLC companies and its subsidiaries.

To qualify, you must meet the minimum criteria such as follows:

- Must be 18 years old and not more than 60 years at the time of application;

- Must be in service for at least 3 months with the company; and

- Must earn a minimum of RM1,600 per month.

How much money can I borrow?

Depending on the outcome of a credit check and preferred instalment payment method, you can borrow up to RM400,000 for a maximum of ten years.

- Instalment method by salary transfer to Bank Rakyat: up to RM400,000 financing amount

- Instalment method by BPA: up to RM400,000 financing amount

- Instalment method by salary deduction: up to RM400,000

- Instalment method by electronic payment: based on income multiplier or RM200,000, whichever is lower (see the table below)

| Income | Eligibility |

| RM1,000 - RM5,000 | 5x monthly gross salary |

| RM5,001 - RM10,000 | 8x monthly gross salary |

| More than RM10,000 | 10x monthly gross salary |

The profit rate charged to this personal financing is fixed with Takaful coverage, based on your selected instalment payment methods.

If you decide to go without the Takaful protection plan, an additional rate of 1.04% will be charged over the current profit rate.

Are there fees and charges I need to know?

Pinjaman Peribadi-i Awam charges zero processing fees.

You only need to pay Government Stamp Duty, which is calculated as 0.50% of the total borrowed and a Wakalah Fee for obtaining this Islamic personal loan.

Do I need Takaful coverage?

Although Takaful coverage is optional, you are advised to sign up for a Takaful policy from Bank Rakyat's panel of Takaful providers.

Takaful coverage can help cover your outstanding personal financing balance in the event of death and permanent disablement.

What is my monthly instalment?

Your monthly instalment will begin the month after you have received and utilized the money.

You will be given a personal financing payment schedule together with your loan agreement document upon approval.

Please note that the table of monthly instalments shown above is for fixed financing rate, with the applicable payments: Salary Transfer, Biro Perkhidmatan Angkasa and Salary Deduction.

For floating financing rate, you may refer to the table below:

| Payment Type | Tenure (Month) | Profit Rate (Floating) |

| Salary transfer to Bank Rakyat | 12 - 120 | SBR + 3.78% to 4.07% p.a. |

| Biro Perkhidmatan Angkasa and Salary Deduction | 12 - 120 | SBR + 2.42% to 2.77% p.a. |

| Electronic Payment | 12 - 120 | SBR + 4.42% to 4.77% p.a. |

*Current Bank Rakyat's Standardised Base Rate (SBR): 2.75%.

Can I settle my Pinjaman Peribadi-i Awam off early?

Yes, you can make an early settlement of your Bank Rakyat personal financing at zero cost.

In fact, you will be granted an ibra' (rebate), i.e. deferred profit which has not been accounted as profit earned.

What documents are required to apply for Pinjaman Peribadi-i Awam?

As this is unsecured personal financing, you don't need to provide a guarantor or collateral to back up your application.

Bank Rakyat will ask for personal and income documents such as:

First-time applicants:

- Copy of IC/MyTentera (front and back)

- Latest 3-months salary slip

- Latest 3-months bank statement of the salary crediting account

And any one of these:

- Confirmation Letter from your Employer

- EA form

Returning customers:

- Copy of IC/MyTentera (front and back)

- Latest 3-months salary slip

Am I qualified to apply for Bank Rakyat Personal Financing-i Public if I'm blacklisted?

Depending on your credit history with other financial institutions because all this information (outstanding credit card, personal loan, home loan or car loan debts) will be captured in CCRIS / CTOS (a system that collects credit information on borrowers, not blacklisting them).

Assuming you have poor credit standing due to irregular payments, the best course would be to break the habit and start making your payments on time to avoid future hurdles.

Bank Rakyat is more likely to approve your Bank Rakyat Personal Financing-i Public application if you can show that you are managing your personal finances, rather than accumulating more debt.

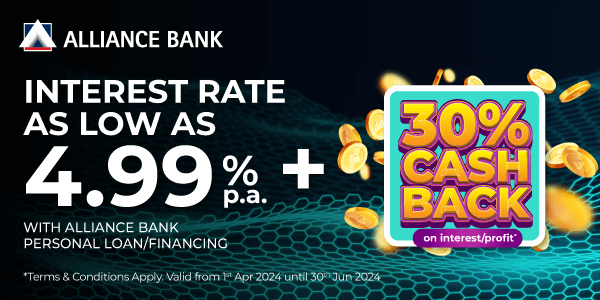

Low Profit Rates

Low Profit Rates