Who can apply for BSN MyRinggit Executive-1 personal loan?

BSN MyRinggit Executive-1 personal loan is open to both permanent and contract employees with a minimum of one year of working experience.

Any Malaysian citizens aged between 21 to 55 / 60* years (*subject to employer confirmation) with a minimum gross monthly income of RM3,000 for permanent and RM10,000 for contract staff respectively.

This BSN personal loan is offered exclusively to those working in:

- Statutory Bodies, Government Linked Companies, selected Public Listed Companies in the Main Market Bursa Malaysia; OR

- Professionals (such as Doctors, Lawyers, Architects and Accountants); OR

- Premier Developer Panels, Private Hospitals, Telecommunication Companies, Licensed Financial Institutions, and Multinational Companies; OR

- Petronas Group of Companies; OR

- Selected Private Universities & Colleges.

How much money can I borrow?

Whatever your personal financing needs may be, BSN Executive-1 personal loan can help part-finance your dreams from a minimum of RM5,000 up to 10x of your gross monthly income, capped at RM400,000, with repayment terms between two to ten years.

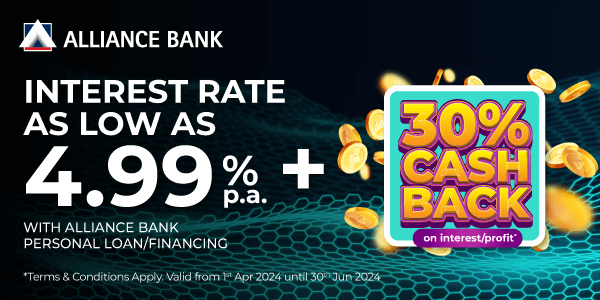

You can choose to service your monthly instalment over a fixed or floating interest rate. If you want to maintain paying the same instalment amount every month, a flat interest rate between 6.00% to 8.50% will be assigned to your loan amount.

Is there an Islamic option for this BSN personal loan?

Absolutely. For borrowers who like to adhere to their religious values, i.e. non-interest-based financing, BSN offers a Shariah-compliant Executive-1 facility that follows the concepts of Tawarruq or Commodity Murabahah at competitive profit rates.

The profit rates, financing amount and tenures will be similar to its conventional counterpart.

What is my monthly commitment for BSN Executive-1 personal loan?

Your BSN personal loan repayments start one month after you’ve received the money, with the payments that need to be made every month until the total loan amount is repaid. BSN requires you to enrol into its Giro or Giro-i Account and set up a Standing Instruction for this purpose.

You can finish paying for your personal loan whenever you want as there is no lock-in period and no penalty for early settlement, just inform BSN by way of a written notice.

What documents do I need to prepare for this BSN personal loan application?

You will need the following documents for your BSN Executive-1 application:

- Copy of your IC (front and back);

- Latest 3-months salary slips;

- Latest EPF statement; AND

- Copy of a confirmation letter from your employer with details of your Name, IC number, Designation / Status, Monthly Salary, Date of Employment and Date of Retirement.

Alternatively, for business owners, please prepare the latest EA / EC statement and e-Filing form or any relevant documents that are verified by the Inland Revenue Board (LHDN).

Am I qualified to apply for BSN personal loan if I'm blacklisted?

Depending on your credit history with other financial institutions because all this information (outstanding credit card, personal loan, home loan or car loan debts) will be captured in CCRIS / CTOS (a system that collects credit information on borrowers, not blacklisting them).

Assuming you have poor credit standing due to irregular payments, the best course would be to break the habit and start making your payments on time to avoid future hurdles.

BSN is more likely to approve your personal loan application if you can show that you are managing your personal finances, rather than accumulating more debt.

10x Monthly Income Financing

10x Monthly Income Financing