The all-new CIMB Travel World Credit Card is your next great companion for all your travels. Get rewarded with Bonus Points every time you spend and travel with peace of mind with complimentary airport lounge access and travel and travel medical insurance, in addition to privileges exclusively by Mastercard, plus CIMB deals all year long.

Up to 8x Bonus Points to collect

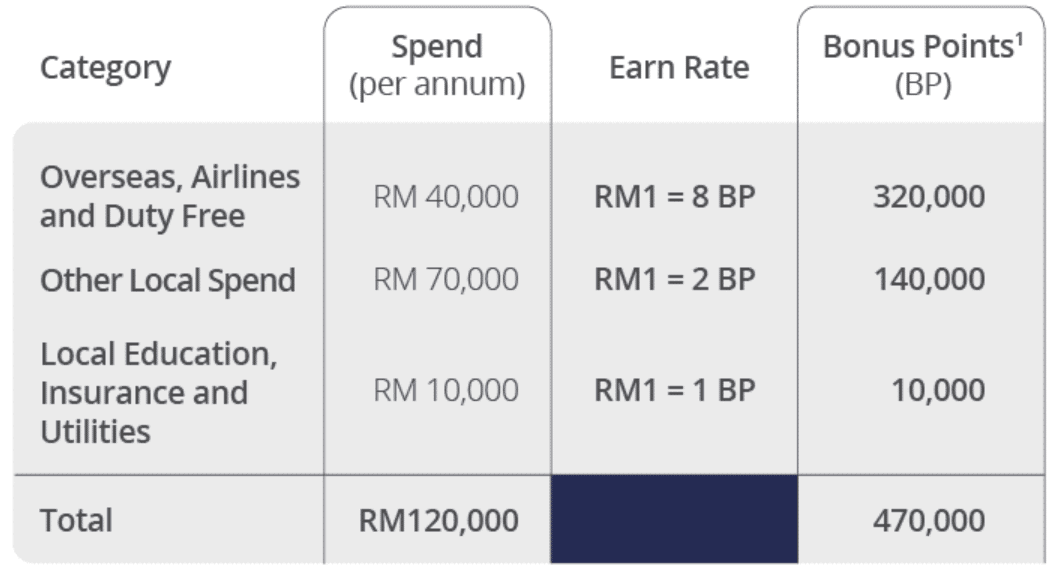

For every RM1 spent with this CIMB Travel World Credit Card on these categories: overseas, airline and duty-free shopping, you’ll earn 8x Bonus Points. Meanwhile, other spending locally gets you 2x Bonus Points and spending on local education, insurance and utilities earns you 1x Bonus Points.

The more you spend, the more accelerated the points that you will get—check out the illustration by CIMB below.

With that amount of Bonus Points, you can redeem flights and hotel stays from CIMB’s airline partners and hotel chains. We’ve compiled a list of the airline partners’ miles/points/Avios in the table below. Do note that the redemption must be made in multiples of 1,000 partners’ Points/Miles/Avios.

| Airline Partners | Air Miles/Points/Avios (per 1,000) |

| Air France-KLM British Airways Etihad Airways EVA Air Japan Airlines Turkish Airlines Qatar Airways Emirates Cathay Pacific | 15,000 |

| Malaysia Airlines | 12,500 |

| AirAsia | 8,000 |

| Hotel Chain Partners | Hotel Points (per 1,000) |

| IHG Hotels & Resorts Marriott Bonvoy | 10,000 |

| ALL - Accor Live Limitless | 25,000 |

Travel perks in one card

Other than Bonus Points and flights and hotel stay redemptions, this travel card offers all the travel perks that you can think of, such as access to airport lounges, comprehensive travel insurance and exclusive Mastercard privileges. Let’s unravel the travel perks one by one.

- Up to 12x access to participating Plaza Premium Lounge

Every quarter of the year, you as the principal cardholder, get 3x free passes to participating Plaza Premium Lounge when you hit a minimum quarterly spend of RM6,000. You can share the free access with your supplementary cardholder as well. Capped at 12x lounge access per annum, this privilege is subject to terms and conditions. Simply present your CIMB Travel World Credit Card, passport or IC and a valid boarding pass to access.

- Up to RM50 cashback for in-flight WiFi service

If you need to use the in-flight WiFi service, you can purchase it using this travel credit card to earn cashback capped at RM50 per principal cardholder per statement date based on posted transactions with predetermined airline merchant category codes. Click here for the full T&C.

- Complimentary 3-month HoteLux Elite Membership

Take advantage of this credit card to enjoy the perks of joining the HoteLux Elite Membership. Simply download the mobile app and sign up as a member or log in you already are a member, search for “Join HoteLux Elite” and click “Promotion”, select “CIMB Card”, insert the first 6-digit of the card number, and voila! This promotion ends on 14 July 2024. Full T&C here.

- Enjoy a 3-night stay at selected Club Wyndham Asia hotels

Valid until 31 December 2024, enjoy a complimentary 3-night stay at exclusive hotels of Club Wyndham Asia namely Wyndham Grand Phuket Kalim Bay, Zenmaya Oceanfront Phuket, Trademark Collection by Wyndham or Bali Ayodya Nusa Dua. This privilege includes daily breakfast for two and a USD50 F&B and spa voucher.

Simply meet a minimum RM5,000 spending requirement in the calendar month of your anticipated stay on the principal CIMB Travel World card to enjoy this privilege. If you fail to meet the spending criteria, there will be an RM3,000 chargeback on your credit card statement.

Late cancellation and date change penalty applies, in addition to taxes and surcharges. If you're keen, you may make a booking via WhatsApp at +63 920 986 3876 or email at [email protected]. Advance booking of up to 3 months is allowed. Full T&C here.

- Comprehensive travel insurance and travel medical coverage

Whenever you buy flight tickets in full using the CIMB Travel World Credit Card, you will be automatically covered with up to RM1 million worth of travel insurance in which you are also covered from travel inconveniences such as luggage loss, flight delays, loss of deposit, flight cancellation, including overseas hospitalisation allowance due to COVID-19. For the complete T&C, click here.

- Medical and COVID-19 coverage during travel

To enjoy this privilege, you will need to pay for your flight tickets in full with the CIMB Travel World Credit Card and register before the start of your trip. Subject to T&C, this coverage is valid for 12 months and starts on the day of the successful registration. Some of the coverage that you get includes Medical Expenses for injury or sickness and Emergency Medical Evacuation/Return of Mortal Remains of up to USD100,000 each, up to USD100 per day (up to 14 consecutive days) for Overseas COVID-19 diagnosis Quarantine Allowance, and other coverage.

- Exclusive privileges from Mastercard

| Mastercard Southeast Asia Gold Program | 50% off green fees at participating golf clubs* 50% off golf lessons at Golf Performance 360 Golf Academy* *Note: Both offers are subsidised by Mastercard and are not direct offers from the respective golf clubs. Click here to make a booking. Click here for the complete T&C. |

| Mastercard Concierge Service | Travelling abroad and need assistance? Mastercard has got you covered with a 24/7 concierge service for your needs. Click here for the complete T&C. |

| Mastercard Airport Concierge Meet & Assist | Enjoy 15% off on the Mastercard Meet & Assist service. You’ll get a dedicated agent that will escort you through the airport during departure, arrival or connecting flights. Click here to sign up and for full details. |

| Mastercard Airport Limo by DragonPass | Need a lift? Get first-class transportation service from airports to your destination and vice versa with Mastercard Airport Limo service. Click here to find out more and make a booking. |

| Mastercard Travel & Lifestyle Services Premium (MTLS) | Enjoy premium benefits at over 3,800 hotels and resorts globally such as: 1. Complimentary breakfast for two daily 2. Room upgrade at the time of arrival (depending on availability) 3. Early check-in and 3 pm check-out (depending on availability) 4. Amenities worth up to USD100 (depending on availability and varies by properties) Click here to sign up. Click here to find out more. |

| Complimentary One-Night Stay | You are entitled to a one-night stay at participating hotels, subject to validity depending on the hotels. T&Cs apply. |

| Wyndham Hotels & Resorts Membership | Enjoy a Platinum Membership and get multiple perks such as the following: 1. Member savings 2. Preferred room choice 3. Complimentary WiFi 4. Early check-in & late check-out, etc. Please note that you must register as a member with the Wyndham Rewards before registering for the Mastercard privilege. Click here for the T&C and guide to register. |

| Mastercard Pay Now Travel Later | Pay for your stay in advance and fly later. Enjoy the flexibility of a one-time free waiver to change your travel dates. Click here to find more details. |

Annual fee for a CIMB Travel World Credit Card

This credit card comes with an annual fee of RM554.72 for the principal card, while it is complimentary for the supplementary card. You can get it 100% waived with total annual spending of RM120,000 and above, or 50% waived for RM60,000 and above.

The total annual spend identified as the accumulated 12 months' retail spend before the card's annual fee date applies to a combined total of both principal and supplementary cards, according to CIMB.

What are the eligibility criteria to apply?

Anyone aged 21 years old and above with a minimum annual income of RM100,000 can apply as the principal cardholder of the CIMB Travel World Credit Card, while the supplementary cardholder must be at least 18 years of age to be eligible.

Up to 8x Bonus Points to earn!

Up to 8x Bonus Points to earn!