ringgitplus

12th February 2018 - 13 min read

Employee’s Provident Fund (EPF) have recently announced the dividend for 2017 at 6.9%, an amount that is significantly higher than 2016 which saw EPF giving out a dividend of 5.7 %. The dividend was the highest since the EPF announced a 7.7% payout to members for 1996. As of 2017, 50.45% of EPF’s investment assets are in fixed-income instruments with the EPF’s investment asset value touching RM771.20 billion, a whopping RM40.09 billion higher than the RM731.11 billion which was announced in 2016.

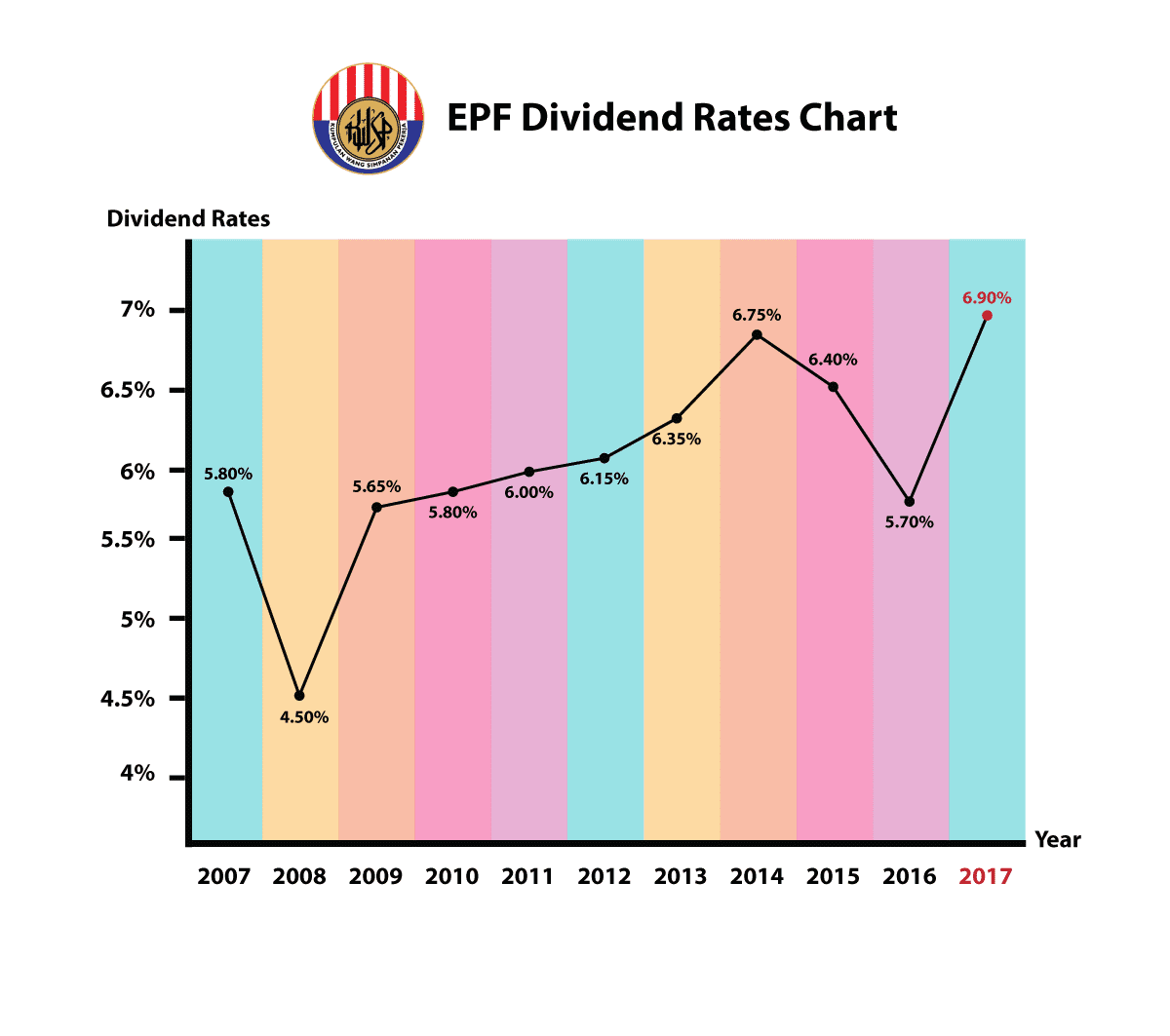

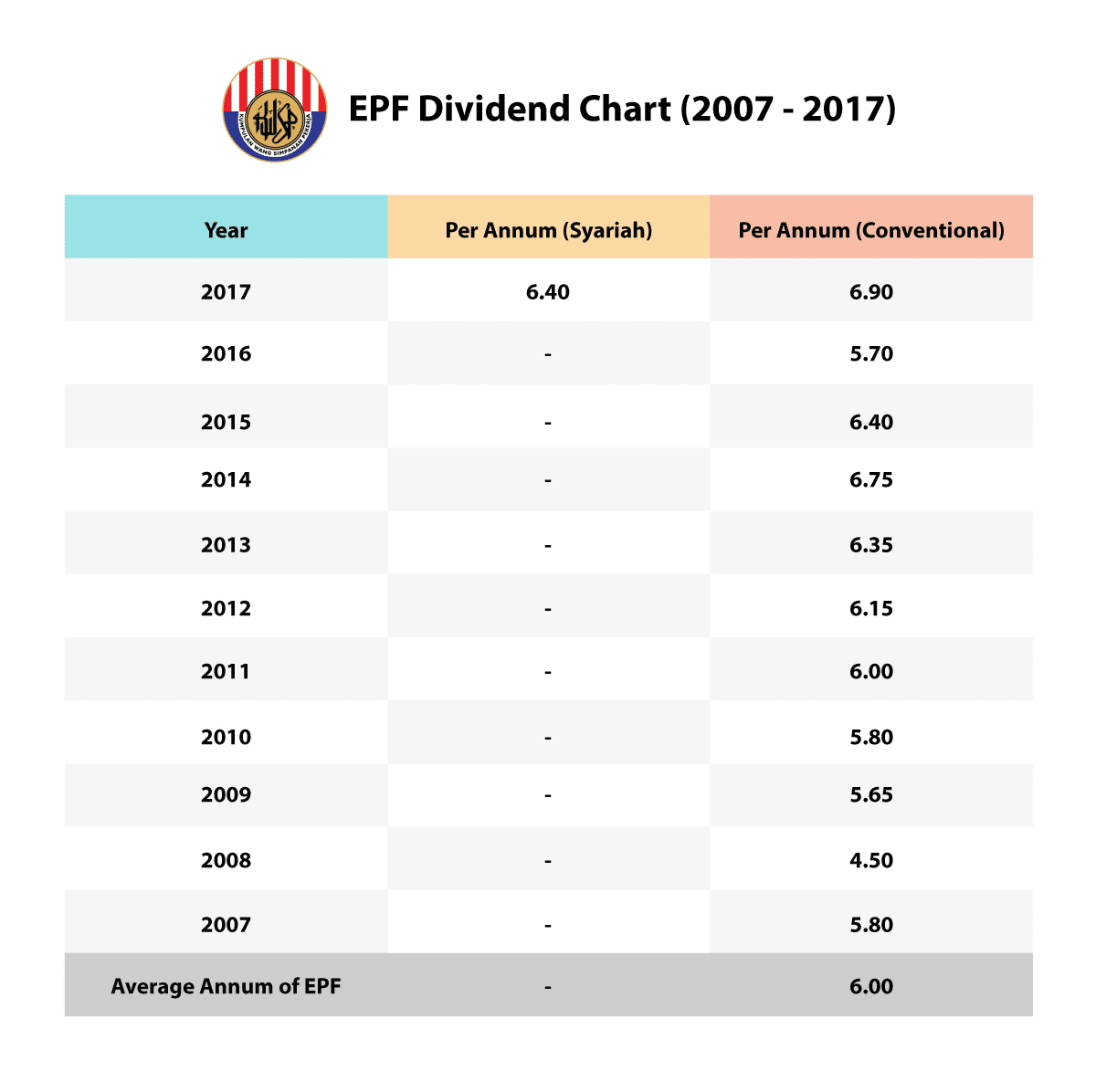

#What Are the Dividend Rates of Previous Years Announced By EPF?

As we can see over the past 10 years, the lowest EPF dividend was announced back in 2008 at 4.5 %. In this particular year, the 2008 financial crisis is said to have started in the United States due to the excessive use of credit. Even though the impact on the local economy was not as shocking as the one that occurred in 1997-1998, it is noted that the dividend rates for EPF have never gone past 7% again.

Prior to the dividend rate for 2017, the highest rate announced for EPF’s dividend was in 2014 which saw an increase of 2.25% from the dividend rate announced 6 years ago. In general, the dividend rate for most years (2011 – 2015) remained at a constant 6 percentile and this was often compared to 2016’s dividend rate which was 5.70%. To quote Chairman Tan Sri Samsudin Osman, EPF faced a challenging investment climate due to unsettling events such as Brexit and the US Presidential elections.

For the year of 2016, EPF attributed their lower dividend rate due to the slower global growth while navigating between changes in the monetary policies in major economies, the slump in crude oil prices and weaker domestic currency. This has then improved in 2017 as the performance for equity and overseas investment has performed remarkably well, thus leading to the current year dividend rate of 6.9% for conventional savings and 6.4% for sharia savings.

Average EPF dividend over the past 10 years

#How EPF Dividends Are Calculated

Under Section 27 of the EPF Act 1991, the guaranteed minimum dividend rate is 2.5% per year on members’ savings. As such, members are guaranteed to receive the minimum dividend rate in any situation. As for how the dividend rates are decided, you may be interested to know that the rate of dividend is proposed by the EPF Management to the EPF Board. Prior to receiving the endorsement by the EPF Board, the EPF management will seek the Minister of Finance’s approval for the declaration of the dividend rate.

Here’s the formula that has been provided by EPF :

Dividend Rate = Net income (a) x 1% Total for a 1% dividend (b)

Investment income + Non-investment income – Expenses

Total for a 1% dividend is based on:

Opening balance of contribution (after withdrawal) that obtain dividend for a 12-month period, and

Monthly contribution that obtain pro-rated dividend i.e. dividend for the n-month will get (12-n) month dividend. For example, the September contribution (n=9) will obtain a 3 months dividend.

Generally, dividends are separated into two types of calculations, the former being the annual compounded dividend and the later being a pro-rated monthly dividend. Bear in mind that your dividend will always be calculated based on the previous day’s outstanding balance.

#What Are the Things That You Can Do With Your EPF?

Buying a House

You can withdraw from your EPF to service a home loan if you’re purchasing residential property. There are many circumstances and conditions for the maximum amount allowed but the withdrawal guideline is either 10% of the house price or all of Account 2. To qualify, you would need to provide the Sale and Purchase Agreement which is not more than 3 years from the date of application among other related documents as listed in EPF’s website.

Pursue Your Studies (Education)

Planning to settle your PTPTN loan but don’t have the means to do so? You can make a withdrawal request from EPF to repay your loans in full or in part using your available balance in Account 2. Just like your housing loan repayments; you will need to apply for a balance report from PTPTN and submit this along with the relevant documentation as required by EPF.

If you are gainfully employed and working, you can do this for yourself or if you have any children that you are currently supporting, you can also make an EPF withdrawal for your children’s education.

If you are planning to pursue your post-graduate studies, you can also rely on your EPF to finance your education fees. You can opt to withdraw once per academic year or each semester. Be aware though that you will need to provide the original offer letter from your university as well as a letter of confirmation from your university. You will need to pass this letter to KWSP so that they can deduct the payment from your account for your education-related fees.

Just visit KWSP’s website to cross-check and see if the education institution and course you are enrolling in qualifies for EPF withdrawals. The amount you are able to withdraw will be limited to either the number of fees or the amount you have available in Account 2, whichever is lower.

Settling Existing Home Loans

If you have an existing house loan, you can lighten the load with your EPF savings. You could either choose to settle a lump sum payment (capital repayment) or opt to have EPF service the monthly repayment. For a lump sum payment, the amount depends on how much you have available in account 2 or the total balance of your loan whichever is lower.

For monthly repayments; you will also only be allowed to take out the available balance from account 2. Calculate how many payments you can make with the available balance and fill in the form accordingly. EPF will block the entire amount and make the payments every month automatically.

However, this means that the full amount is removed from your EPF account and you will not be receiving any interest from EPF on it. As such; many customers prefer to take out lump sum amounts and have their banks convert it into advance payments.

To perform either withdrawal method, you will need to request a balance statement from your bank. The statement is specifically for EPF purposes and will contain details of the property as per your Sale and Purchase Agreement as well as your loan details.

The amount withdrawn from EPF will then be credited directly to your home loan account. Your Account 2 funds can also be used to reduce/redeem a housing loan on behalf of a spouse or immediate family member. All withdrawals are subject to a minimum withdrawal of RM500 or all of Account 2 savings.

Get Medical Treatment/Aids

Yes, you can seek for medical help too by making a request for health withdrawal. For this type of withdrawal, you can get EPF to help cover the medical expenses for critical illnesses and/or to buy healthcare equipment. Do note that you will need to refer to the list of approved critical illnesses and medical equipment at the EPF official website or EPF office.

Upon approval, EPF will cover the medical expenses and this includes all charges by the hospital / medical center for the treatment given to the patient, including the cost of equipment to treat the approved illness.

Members may withdraw all savings in Account 2 OR according to actual medical cost, whichever is lower. Should the situation in which the medical cost has been partially paid for by the member’s / patient’s employer occurs, the withdrawal amount should only cover the remaining balance of the medical costs that are not covered, subject to the balance of savings in member’s Account 2.

Having said that, there are clauses to this withdrawal in which you will not qualify for the withdrawal if:

-The illness is not stated in the EPF’s list of approved critical illnesses

-The medical aid equipment is not approved by the EPF

- The cost of medical treatment is fully covered by the member’s/patient’s employer or any family members’ employer

- The member/patient is receiving alternative treatments such as acupuncture or any other traditional medication.

Read Also : Should You Pay Off Your PTPTN Debt With Your EPF Money

Participate in an Investment Scheme

The scheme allows members to transfer a portion of their savings from Account 1 for investments in order to enhance their retirement savings. Members may invest no more than 30% from the savings in excess of the Basic Savings Amount in Account 1 through appointed Fund Management Institutions (FMIs).

Approved FMIs under the scheme includes Unit Trust Management Companies (including Amanah Saham Nasional Bhd), Asset Management Companies and Lembaga Tabung Haji. Unit Trust Management Companies provide members the option for their investment to be invested in Unit Trusts. Members may elect for their investment to be managed by Asset Management Companies through a private mandate.

Interested to start investing? Well, keep in mind that all investments must be made through the appointed FMIs. You can refer to a list of approved FMIs from the EPF website. Apart from that, even though these investments are allowed by EPF, you are fully responsible for the investments that you participate in and EPF claims no liability for any losses incurred.

You are also reminded to scrutinise and comprehend all Fund Prospectuses before proceeding to make any investment decisions.

In the situation that your investments are able to churn a profit, it is expected for you to return all amounts to the EPF (including profits made) upon liquidation of investments. The money will then be credited into the members’ Account 1.

You will not be allowed to withdraw any amount from the money invested through the FMIs to ensure that there are no leakages in funds.

#What Are the Advantages of Using EPF for Private Retirement Scheme?

Private retirement scheme allows you more flexibility in managing your investment and deciding every month, how much you would like to contribute. The EPF scheme requires a form filled and the new additional amount will stay until you request in writing to remove it.

EPF will also decide where to invest your money and will manage the fund for you. Many of those who have some knowledge investments and yields may want to have more say in how their funds are invested. Read here to learn more on private retirement schemes and how it can help you in your investment portfolio.

From 2014 to 2018, the government announced they would be giving PRS members between 20 to 30 years old a one-off incentive of RM500 to purchase units of PRS funds to encourage young people to start saving more for their retirement.

#What Are the Disadvantages of Using EPF for Private Retirement Scheme?

You may have more flexibility in the investment side of things, but you have less flexibility in partial withdrawals prior to your retirement age.

70% of your PRS contribution is placed in sub-account A and the other 30% in sub-account B. Withdrawals are only restricted to sub-account B, which you could only withdraw from once a year and an 8% penalty would be incurred.

#What Are the Advantages of Using EPF for Investment Schemes?

Get an upper hand in managing your investment portfolio

You will be offered the chance to plan on how you want to invest your savings, all of which that will rely heavily on your comfort level with financial risk. If you are looking to make full use of your EPF contributions throughout the years to select funds and diversify their portfolio, then this is something that you should definitely look into.

Stand a chance to yield higher returns

The EPF has returned dividends averaging from 5% to 6% between 2009 and 2017, but you could certainly earn more through unit trust investments if you are a savvy investor. If you make a profit, you can simply reinvest the sum and start building a strong portfolio.

No need to touch your savings or other liquid assets

Your savings will be used to invest instead of your EPF. As such, trying to build your nest egg through this method will not affect your current circumstances and savings expectations. Also, do note that by investing in an EPF scheme, you will gain access to funds that will not charge any interests and best of all, you will only need to a minimum fee to do so.

#What Are the Disadvantages of Using EPF for Investment Schemes?

All investments come with a risk tag attached to it

Succinct to say, although unit trusts are viewed in general as a safe investment for beginners, do note that your returns aren’t actually guaranteed. As a matter of fact, this can greatly detrimental to your retirement fund and if you do not have any other passive income after retirement, you will definitely have lesser to spend in your sunset years. All investments come with risk and this can range from poor fund management, geopolitical factors, inflation and more.

** You will need to pay fees to be able to invest **

As, your investment will be subjected to service, transfer, and management fees, all of which that’s understandable as you are after all paying for a service to help your money grow. And in the situation that you do not want to be in an investment scheme anymore, you will be charged exit fees as well and this could be from 2% to 4% of your investment fund, all of which that relies greatly on the fund management institute. As it is, if your dividend earnings are not exactly sufficient, you might not see as big a profit as you’d like.

*Your profits may be subject to tax *

Bear in mind that investment schemes such as Amanah Saham Wawasan may be approved by the Ministry of Finance to be tax-exempted, the same can’t be said for all other incidentals such as dividends. As such, do look into the funds that are you are planning to invest into, discover their overall costs so that you can maximise your investment to harness its full potential for your return of investment.

#Are There Any Other Things That I Should Know?

Whatever your investment preferences or decisions may be, some of the above options may be worth considering if you would like to put your retirement savings to work. After all, you definitely want to ensure that this money is safely stowed in your account for those occasions when you need to withdraw it.

On the other hand, if you do have some extra money stashed up and would like to make full use of it to earn safely with guaranteed returns, do consider a high-interest savings account. To maximise the potential of your hard earned cash, just head over to our comparison tool and we’ll help you find an account just right for you.

Which option would you go for – private retirement scheme, ASB loan, unit trusts or perhaps you would prefer to maintain your EPF account until your golden years? Tell us in the comments section below.

Comments (0)