Jacie Tan

3rd May 2019 - 2 min read

Alliance Bank will be revising the cashback rates on its You:nique Rebates card come 21 May 2019. The revision will see reduced cashback rates for the lower-tier spending on the card.

The Alliance Bank You:nique Rebates credit card offers cashback on all retail purchases every day of the week. If offers tiered cashback with different percentages of cashback that apply only to the amount spent in that range. This is unique to the You:nique Rebates card, as other cashback cards offer tiered cashback rates that apply to the entire amount spent in the statement cycle.

Currently, the You:nique card offers 0.5% cashback for the first RM1,000 on retail spending in a month and 1.5% for the next tier of RM1,001–RM2,000. After 21 May, You:nique cardholders won’t earn any cashback for the first RM1,000 of expenditure and will get a reduced rate of 1.2% for the second tier. The rate for Tier 3 and 4 will remain the same.

| Cashback tier | Range | Current rates | New rates |

| 1 | RM0–RM1,000 | 0.5% | 0% |

| 2 | RM1,001–RM2,000 | 1.5% | 1.2% |

| 3 | RM2,001–RM3,000 | 3.0% | 3.0% |

| 4 | Above RM3,000 | 0.3% | 0.3% |

To get a better idea of how the new percentages affect your cashback earnings on the You:nique credit card, compare the potential cashback amount from before and after the change.

| Cashback tier | Range | Current cashback amount | New cashback amount |

| 1 | RM0–RM1,000 | Up to RM5 | None |

| 2 | RM1,001–RM2,000 | Up to RM15 | Up to RM12 |

| 3 | RM2,001–RM3,000 | Up to RM30 | Up to RM30 |

| 4 | Above RM3,000 | Unlimited | Unlimited |

Under the old rates, if you spent up to RM3,000 on retail transactions using your You:nique credit card, you would receive a total of RM50 in cashback. After the change, you will receive RM42 for the spending the same amount.

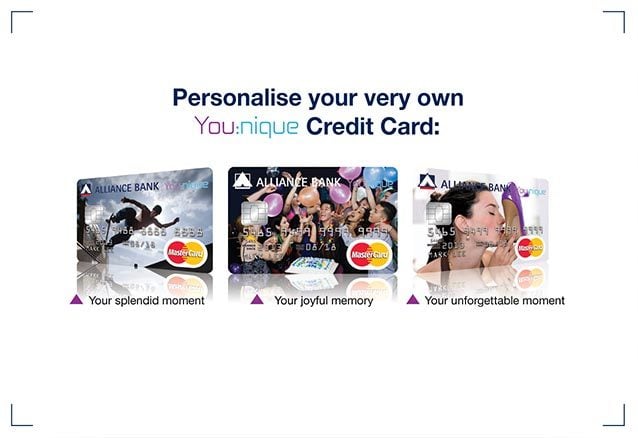

Alliance You:nique allows you to upload your own card face design so that you can have a truly personalised credit card. Besides the Alliance You:nique Rebates card, there are two other variations of the You:nique credit card that offer benefits on low interest rates and rewards points respectively.

Comments (1)

Every year, every time, without fail: credit card rewards, points validity, shrinks. Even redeeming points, example 10000 for McD, with GST (during Najip years) another 6% points ie 600 were deducted. End of the day (and decade) it seems we have a saviour. We the rakyat now use Boost, Grabpay, TNG – that rewards us instantly. The only real advantage of credit card is 14-20 days of grace. Same with airlines mileage, year after year, less points, less award, less validity of points. Disgruntled users then seek budget airlines.