Jacie Tan

21st November 2018 - 3 min read

RHB has released two new credit cards, each designed to focus on cashback and rewards benefits respectively. In a twist, RHB is offering the RHB Cash Back Credit Card and the RHB Rewards Credit Card together as the RHB Dual Credit Cards, offering users the best of both worlds.

RHB Cash Back Credit Card

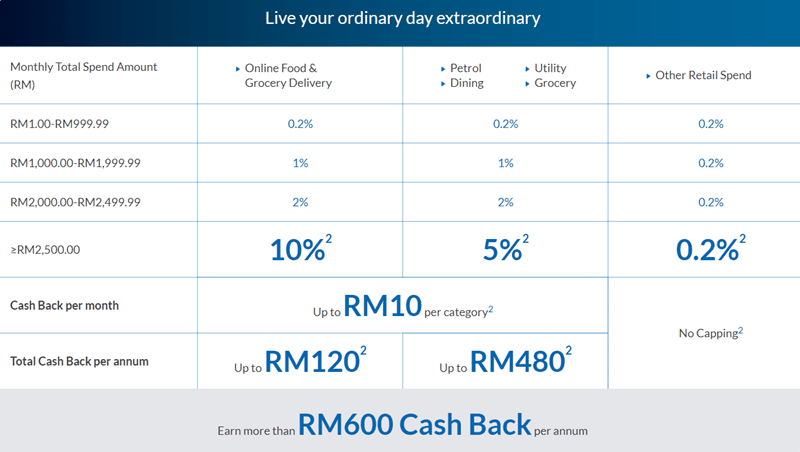

The RHB Cash Back Credit Card offers tiered cashback for five categories up to RM10 per category. The categories are Online Food & Grocery Delivery, Petrol, Dining, Utilities, and Groceries. The percentage of cashback you get depends on how much you spend in total each month.

Spending between RM1–RM999.99 will get you 0.2% cashback, RM1,000–RM1,999.99 delivers 1% cashback, and spending between RM2,000–RM2,499.99 gets you 2% cashback. If you hit a minimum spend of RM2,500 in a month, you get 10% cashback for the Online Food & Grocery Delivery category and 5% for the other four categories.

In short, spending a minimum of RM2,500 a month will unlock the highest rates of cashback on the RHB Cash Back Credit Card: 5% for all the categories except Online Food & Grocery Delivery, which offers 10%. There is a cap of RM10 per category, so assuming you max out the cashback on all five categories, you could get up to RM50 worth of cashback in a month. In addition to this, you’re also eligible for unlimited 0.2% cashback on all other retail spend.

RHB Rewards Credit Card

Meanwhile, the other half of the RHB Dual Credit Cards is dedicated to rewards points. Here’s what you need to know about collecting points using the RHB Rewards Credit Card:

| Expenditure | Rewards Points |

| Movie tickets | 10x |

| Overseas spend | 4x |

| Online & e-wallet | 3x |

| Health & Insurance | 2x |

| Retail shopping | 2x |

| Other retail spend | 1x |

Rewards points can be redeemed on items such as home appliances or tech gadgets, vouchers for food and shopping, or converted into Enrich Miles or AirAsia BIG Points. Rewards points earned with this card have a validity of three years.

RHB Dual Credit Card requirements

For the first year, annual fees for both credit cards will be waived. Subsequently, principal cardholders will have to pay a RM70 annual fee for the RHB Cashback Credit Card and RM200 for the RHB Cash Rewards Credit Card – although these fees will be waived if the cardholder spends RM10,000 in a year. Annual fees for supplementary cardholders are waived.

To find out more about the RHB Dual Credit Cards, you can head on over to the RHB website.

Comments (0)