Heeral Bhatt

4th December 2018 - 5 min read

They’re so good that you won’t know that they’re working their pitches until you’ve purchased more than you intended. That is the power of advertising and is by far the most effective medium in persuading people to buy and creating brand awareness.

Advertising started off in the early 19th century, plotting creative ideas to lure audiences to purchase products and services. To this day, some tricks still work.

Here are a few of the most common – how they get you to spend money and what you can do to counter it!

1. Repetition and Penetration

Simple yet effective, advertisers use this tactic by drilling advertising messages deep into your conscious and subconscious mind to lure you to make a purchase. It is yet the pioneer of all advertising methods and is found to still work.

Ever heard a jingle on TV that you have paid no notice to before, but after a few days you start humming it in your head? If yes, your mind has been successfully infiltrated with the advertising message that was meant to be pitched across.

Now imagine that the repetition involves an ad telling you how delicious a meal is or how wonderfully effective a product is. Whether or not you believe it – the message sticks in your mind the next time you are hungry or out shopping.

2. Glittering Generalities

“Glittering generalities” in advertising language is a tactic that plays on the target audience’s insecurities and fears. This tactic is about tapping into your emotions and then convincing you that the answer to your manufactured problem is the product or service being sold.

Ever heard an advertisement targeting your body weight, or bald spot? You’ve probably seen many and the tactic is as old as time. If I can make you afraid of something (in this case, being a social outcast), I can sell you the antidote.

The recent furore over getting bikini body ready in the US and UK are prime examples of advertisers playing up insecurities. But lately, consumers are buying this trick less and less. Closer to home, Nivea Singapore saw backlash over their ad ‘demonising’ the darkened armpit.

Consumers are getting savvier and social psychology is changing but for the most part, many people still fall into this trap.

3. The Power of Social Media

Not long ago, we talked about how social media affects your spending. But beyond peer recommendations, companies are now using social media in full force to monetise the eyeballs that peruse these sites daily.

You’ve seen those annoying pop-up ads and you’ve probably also seen more targeted advertising appearing on your social news feed. Advertisers are now using online tools to track your searches and interests to further entice you to buy, buy, buy.

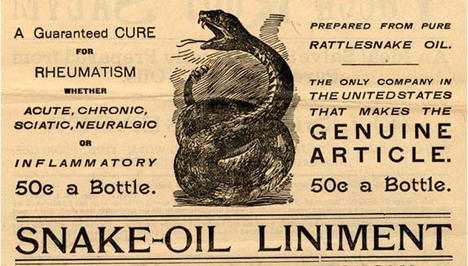

4. Factual Guarantees and Assurances

These type of advertisements are simple, they bombard you with practical and scientific facts with recommendations by professionals. Advertisements as such will give you some sort of credible value and a promise that the product or service will work wonders.

The lure of such an approach is that for particular products (such as those health and safety related); the grim, factual, no-nonsense approach drives more people to believe what you are pitching as the truth.

How to Avoid the Advertising Trap

Advertising can be a good or bad thing depending on how it affects you. If you are able to still make independent purchasing decisions without being affected by advertising gimmicks; good on you.

But if not, here are some ways to avoid spending traps associated with persuasive advertising.

The next time you find yourself deciding to eat somewhere or buy something – stop to ask yourself three questions:

1) Can you afford it?

2) Why have you decided on this brand or outlet?

3) Do you need it or in the case of a necessity like food, can you do with something different that may be just as good and cheaper?

In the case of a fear or insecurity being raked up; it can be helpful to analyse the fear/insecurity first. Is there a real basis for the feeling? Even if there is; is it as dire as it’s been made out to be? Talk to loved ones or an independent party to get a better view of things as a whole.

The ultimate thing to remember is don’t make a decision immediately. The more time you take thinking about it, the wiser your purchase decision will be.

The Verdict

Advertising will never stop bombarding us with all kinds of messages. There are times of course when advertising is useful. In the event you were looking for a type of item or service, advertising can help you find out about the places you can go to to get what you need.

You can even find a new favourite brand or restaurant via the power of advertising. The problem surfaces when it overtakes your ability to make conscious spending decisions, in which case, taking a step back is the best thing to do.

The weekend is here and you’re probably going to be bombarded more than ever with advertisers attempting to sell you something. What better time to practise your deflecting techniques!

Comments (0)