Jacie Tan

6th November 2018 - 7 min read

1) Fuel subsidy for 6.6 million vehicle owners

The government announced a targeted fuel subsidy for those who own a single vehicle with engine capacity of 1,500cc and below. It will be set at an expected rate of least 30 sen per litre. Car owners will get up to 100 litres of subsidised fuel and motorcyclists up to 40 litres. The subsidy will kick in during the second quarter of 2019 and is estimated to cost the government RM2 billion annually.

Those on social media had been quick to point out that there are luxury car brands with engine capacities below 1,500cc, but Finance Minister Lim Guan Eng responded that there was “no hope” for those driving luxury cars to benefit from the subsidy. As it is now, the exact mechanism of this targeted fuel subsidy has yet to be clarified, with Lim asking for more time to iron out a proper system.

2) Toll hike freezes and abolished motorcycle tolls

All intra-city highways will have their toll prices frozen for 2019, costing the government an approximate amount of RM700 million. The toll for motorcycles for the First and Second Penang Bridge, as well as the Second Link in Johor, will be abolished effective 1 January 2019. This will cost the government about RM20 million per annum.

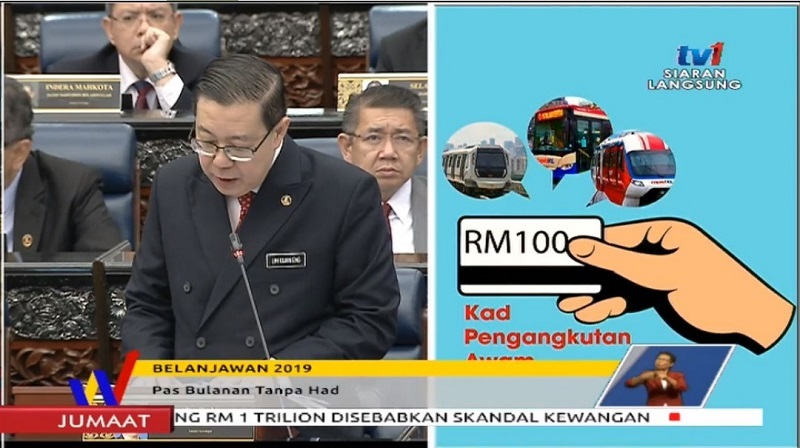

3) Unlimited monthly transport passes

A total of RM240 million will be allocated for an unlimited monthly public transport pass, to increase the utilisation of public transport. In a press conference held by Transport Minister Anthony Loke, further details about the travel pass were announced.

The 30-day unlimited pass comes in two versions – RM100 for use on all Rapid Rail and Rapid bus services, and RM50 for travel on Rapid bus services in the Klang Valley. The new travel scheme will be limited to Malaysians only, through the use of their MyKad. According to Loke, users can start registering for the pass in December and begin utilising it from 12.01am on 1 January 2019.

4) Tax amnesty programme for 2019

A Special Voluntary Disclosure Programme will be launched, giving taxpayers the opportunity to voluntarily declare any unreported income and offering reduced penalties in return. The sooner you declare your unreported income, the lower the penalty you’ll have to pay for evading tax.

- 3 November 2018 – 31 March 2019: 10% penalty

- 1 April 2019 – 30 June 2019: 15% penalty

- 30 June 2019 onwards:80%–300% as provided for in existing tax laws.

5) New taxes introduced by Budget 2019

Here are four of the new taxes that will come into effect over the next year.

Service tax on imported services. Imported services such as architecture, graphic design, IT, and engineering design services will be subjected to service tax starting 1 January 2019.

Service tax on imported online services. Starting 1 January 2019, any Malaysian business that imports online services will have to pay a service tax. Similarly, consumers who are using foreign online services in Malaysia will have their transactions taxed starting 1 January 2020. Affected services include software, music, video, and digital advertising, such as Netflix and Spotify.

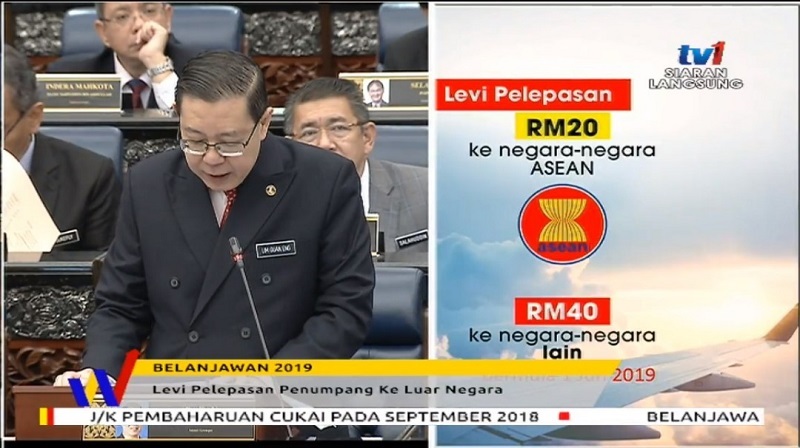

Departure levy. To encourage domestic tourism, the government is imposing a departure levy to those travelling abroad by air starting 1 June 2019. The proposed rate is broken into two tiers: RM20 for outbound travellers to ASEAN countries, and RM40 to countries other than ASEAN.

Sugary drinks tax. From 1 April 2019, there will be a duty of 40 sen per litre on two broad categories of sweetened beverages: non-alcoholic beverages containing added sugars of more than 5gm per 100 ml drink and fruit juice containing added sugars of more than 12gm per 100 ml drink.

6) Gambling industry taxes increased after 13 years

Casino licences are to be increased by RM30 million to RM150 million per annum and casino duty charges will be increased up to 35% on gross collection. Machine dealers’ licences will be increased from RM10,000 to RM50,000 per year, and gaming duties will be increased from 20% to 30% on gross collection.

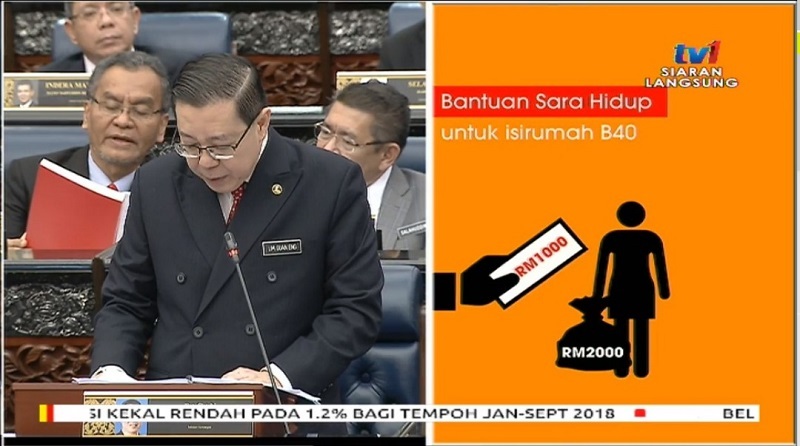

7) B40 households will continue to receive Bantuan Sara Hidup cash grants

The government support for B40 households will be continued under a new “Bantuan Sara Hidup” cash grant scheme. Households with a monthly income below RM2,000 will receive a sum of RM1,000, households with a monthly income between RM2,001–RM3,000 will receive RM750, and households earning between RM3,001–RM4,000 will receive RM500.

For every child 18 years and below or disabled member of the family, there will be an additional top-up of RM120 per child (up to a maximum of four children). 4.1 million households are expected to receive this financial assistance, amounting to RM5 billion in grants in total.

Here’s a comparison of how the new Bantuan Sara Hidup compares to the previous Barisan Nasional government’s BR1M scheme.

8) Assistance for civil servants

To show appreciation to civil servants, the government will be allocating a special payment of RM500 to public servants of Grades 54 and below. Government pensioners will receive a bonus of RM250, with those receiving less than RM1,000 in monthly pensions being eligible for a one-off RM500 assistance.

Muslim civil servants will be given seven days of unrecorded leave to perform their umrah, while to appreciate the 201,600 non-Muslims in civil service, the government will also grant a similar period of unrecorded leave for other religious pilgrimage and functions.

As for government contract staff who do not enjoy the full privileges enjoyed by full-time civil servants, the government will allocate RM10 million per year to extend healthcare services to the parents of these contract staff. Additionally, these contract officers may apply for quarantine leave should their children suffer from any infectious diseases.

9) Steps to encourage working retirees

The government has highlighted that there will be an estimated 1 million Malaysians aged between 61 and 65 years who will still be active and productive, and is proposing steps to encourage their participation in the workforce.

Budget 2019 proposes reducing the statutory employers’ share of EPF contribution for retirees from 6% to 4% and providing additional tax deduction to employers who employ those over the age of 60 up to a monthly salary of RM4,000. Both these steps would incentivise employers to hire or retain retirees, especially those in the B40 category. It is also proposed that the current mandatory employee contribution for this group be set to 0%, to increase the take-home pay of working retirees and encourage them to continue working as well.

10) First-time homeowners win over property investors

The government has taken steps to make it easier for Malaysians to finance affordable homes. On the other hand, those choosing to invest in or purchase higher-end properties may find some of the announcements not so favourable to them. Budget 2019 will increase the Real Property Gains Tax (RPGT) for properties sold after the fifth year from 5% to 10% for companies and foreigners, and from 0% to 5% for Malaysian individuals. The stamp duty charges for transfer of properties valued at more than RM1 million will also be increased from 3% to 4%.

However, for first-time home owners and those looking to buy affordable homes, the government has announced the following steps and initiatives:

- -Housing with prices below RM200,000 will be exempted from RPGT

- -First-time home owners purchasing properties priced up to RM500,000 will have stamp duty waived up to RM300,000

- -The government’s six-month National Home Ownership Campaign will waive stamp duty charges on unsold properties priced between RM300,001 to RM1 million, while developers are to offer a minimum 10% price discount

- -Exempted SST charges on construction and building materials

- -RM1 billion fund offering a concessionary rate for home loans from as low as 3.5% per annum

- -New property crowdfunding initiative

For a full overview of Budget 2019 and how each of its proposals affect you, check out our infographic on Budget 2019 and You.

Comments (0)